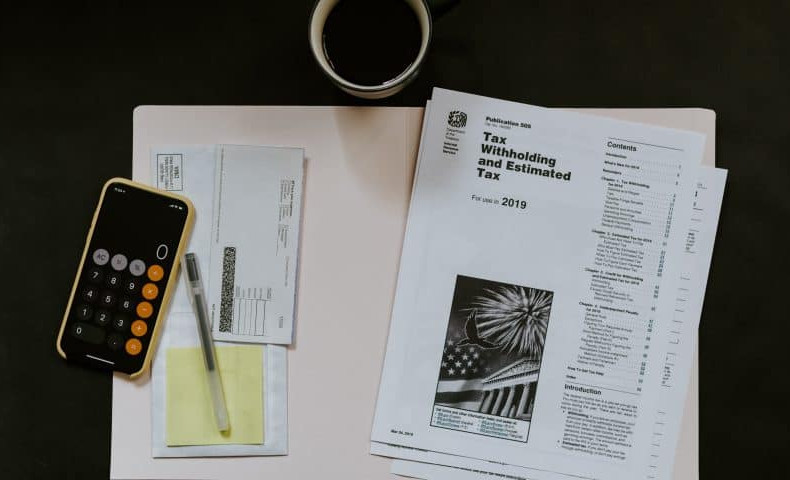

In October, the Social department has several seminars that come with information that we have been requested very often by members of the Romanian community in the Netherlands. We look forward to seeing you and hope you find them useful! "The Dutch tax system. "Belastingdienst" for everyone". The Social Department of Rompro The Romanians for Romanians Foundation Netherlands, with the support of the Department for Romanians Abroad, offers you the seminar...